The Indian government on Friday announced Tata Group as the winning bidder for Air India, clearing the way for the cash-strapped Maharaja going back to the founder exactly 68 years after India had nationalised its private airlines in 1953.

The Tatas pipped SpiceJet founder Ajay Singh with a winning bid of Rs 18,000 crore.

Let’s dive into how Air India started and how it ran before it was handed over to the Indian Government.

Start-

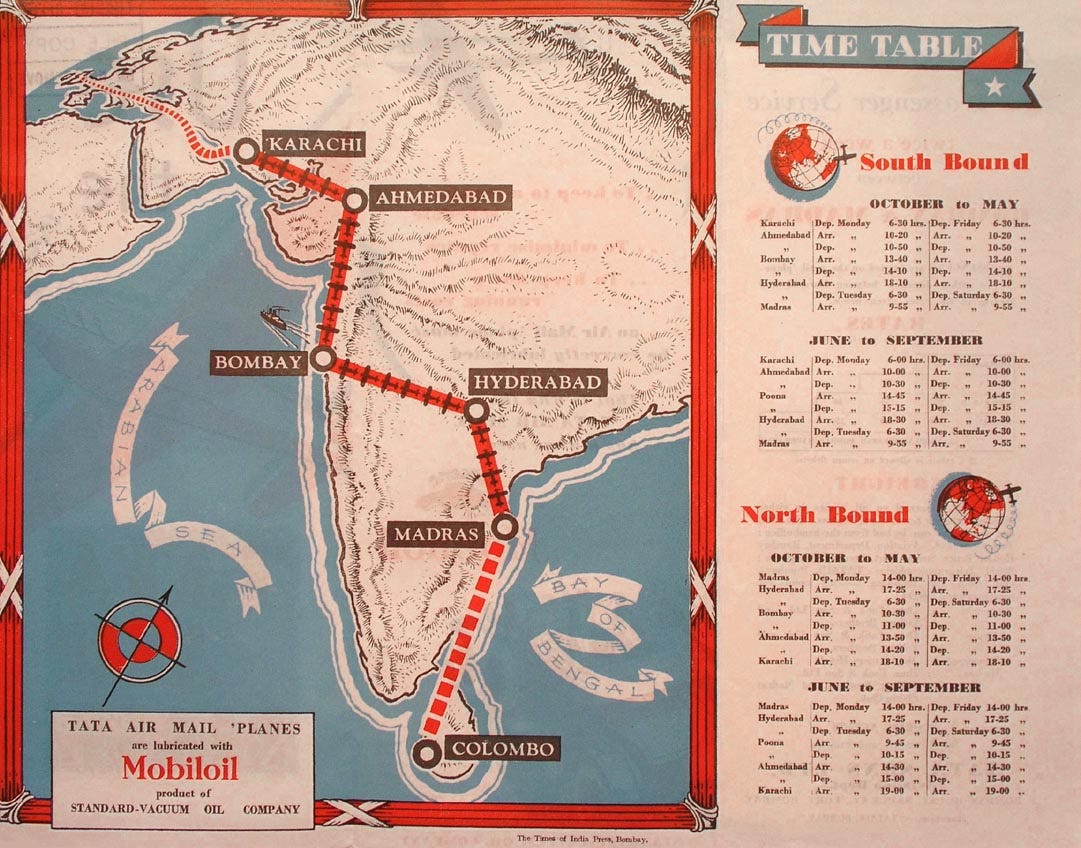

The airline was founded by J. R. D. Tata as Tata Airlines in 1932; Tata himself flew its first single-engine de Havilland Puss Moth, carrying air mail from Karachi's Drigh Road Aerodrome to Bombay's Juhu aerodrome and later continuing to Madras (currently Chennai).

The airline fleet consisted of a Puss Moth aircraft and a de Havilland Leopard Moth. Initial service included weekly airmail service between Karachi and Madras via Ahmedabad and Bombay. In its first year of operation, the airline flew 160,000 miles (260,000 km), carrying 155 passengers and 9.72 tonnes (10.71 tons) of mail and made a profit of ₹60,000 (US$840).

The airline launched its first domestic flight from Bombay to Trivandrum with a six-seater Miles Merlin. In 1938, it was re-christened as Tata Air Services and later as Tata Airlines. Colombo in Ceylon (now Sri Lanka) and Delhi were added to the destinations in 1938. During the Second World War, the airline helped the Royal Air Force with troop movements, shipping of supplies, the rescue of refugees and maintenance of aircraft.

Nationalization-

After World War II, regular commercial service was restored in India and Tata Airlines became a public limited company on 29 July 1946 under the name Air India. After Indian independence in 1947, 49% of the airline was acquired by the Government of India in 1948. On 8 June 1948, a Lockheed Constellation L-749A named Malabar Princess (registered VT-CQP) took off from Bombay bound for London Heathrow marking the airline's first international flight.

In 1953, the Government of India passed the Air Corporations Act and purchased a majority stake in the carrier from Tata Sons though its founder J. R. D. Tata would continue as Chairman till 1977. The company was renamed Air India International Limited and the domestic services were transferred to Indian Airlines as a part of a restructuring. From 1948 to 1950, the airline introduced services to Nairobi in Kenya and to major European destinations Rome, Paris and Düsseldorf. The airline took delivery of its first Lockheed Constellation L-1049 and inaugurated services to Bangkok, Hong Kong, Tokyo and Singapore.

Indian Airlines merger

In 2007, Air India and Indian Airlines were merged under Air India Limited and the airline took delivery of its first Boeing 777 aircraft. The airline was invited to be a part of the Star Alliance in 2007. The combined losses for Air India and Indian Airlines in 2006–07 were ₹7.7 billion (US$110 million) and after the merger, it went up to ₹72 billion (US$1.0 billion) by March 2009.

By March 2011, Air India had accumulated a debt of ₹426 billion (US$6.0 billion) and an operating loss of ₹220 billion (US$3.1 billion) and was seeking ₹429 billion (US$6.0 billion) from the government.

Re-privatization

In September 2021, government-issued fresh tenders for selling the airlines, where Spice Jet's Ajay Singh-led consortium and Tata Sons shown interest in the bid. Finally, On 8 October 2021, Air India, along with its low-cost carrier Air India Express and fifty per cent of AISATS, a ground handling company, were sold for ₹18,000 crores (US$2.5 billion) to Talace Privately Limited, a Tata Sons' SPV.

Significance of this sale

Purely in terms of money, the deal does not result in as big a step towards achieving the government’s disinvestment target of the current year. Moreover, of the total AI debt of Rs 61,562 crore, the Tatas will take care of Rs 15,300 crore and will pay an additional Rs 2,700 crore in cash to the government. That leaves Rs 43,562 crore of debt. The assets left with the government, such as buildings, etc., will likely generate Rs 14,718 crore. But that will still leave the government with a debt of Rs 28,844 crore to pay back.

So, it can be argued that if the government had run AI well, it could have made profits and paid off the debts — instead of selling the airline (that can make profits) and still be left with a lot of debt.

From the Tatas’ perspective, apart from the emotional aspect of regaining control of an airline that they started, AI’s acquisition is a long-term bet. The Tatas are expected to invest far more than what they have paid the government if this bet is to work for them.

Thank you for reading this edition of Sapience. Please share and subscribe if you liked the content and stay tuned for our next “Sapience”.

Follow us on-

Twitter - @mysapiences

Instagram- @sapience.io

Till next time, Ciao!